HIRING IN I.T. & TECH SECTOR DROPS 25% AS BIG TECH FIRMS RESTRUCTURE IN POST-PANDEMIC FIRST

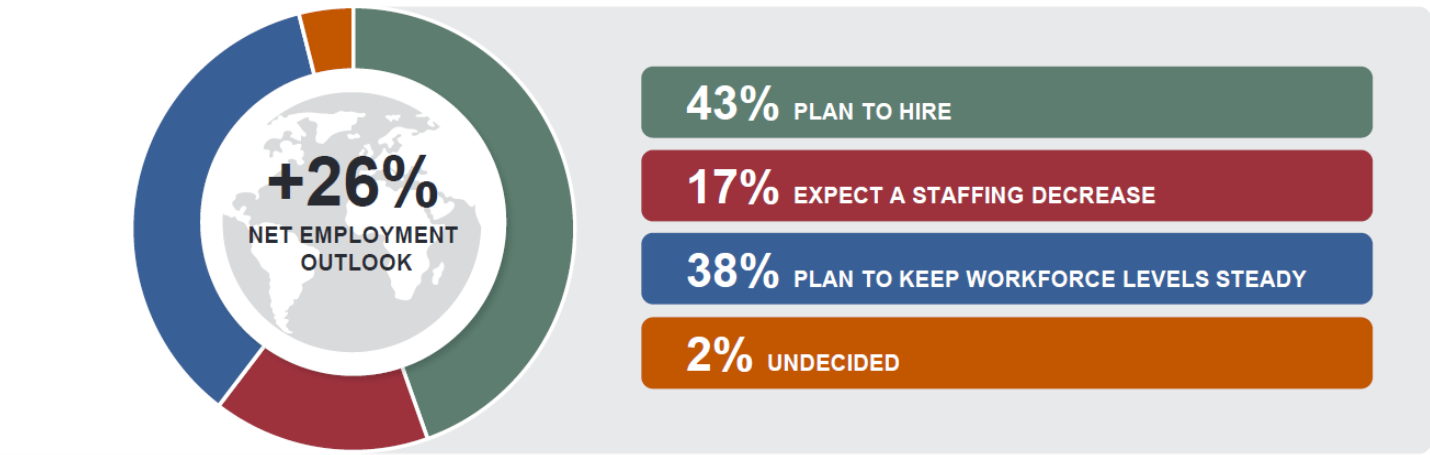

Ireland’s Net Employment Outlook cools to +28%, a positive figure historically, but represents a decline of 12 percentage-points on last quarter.

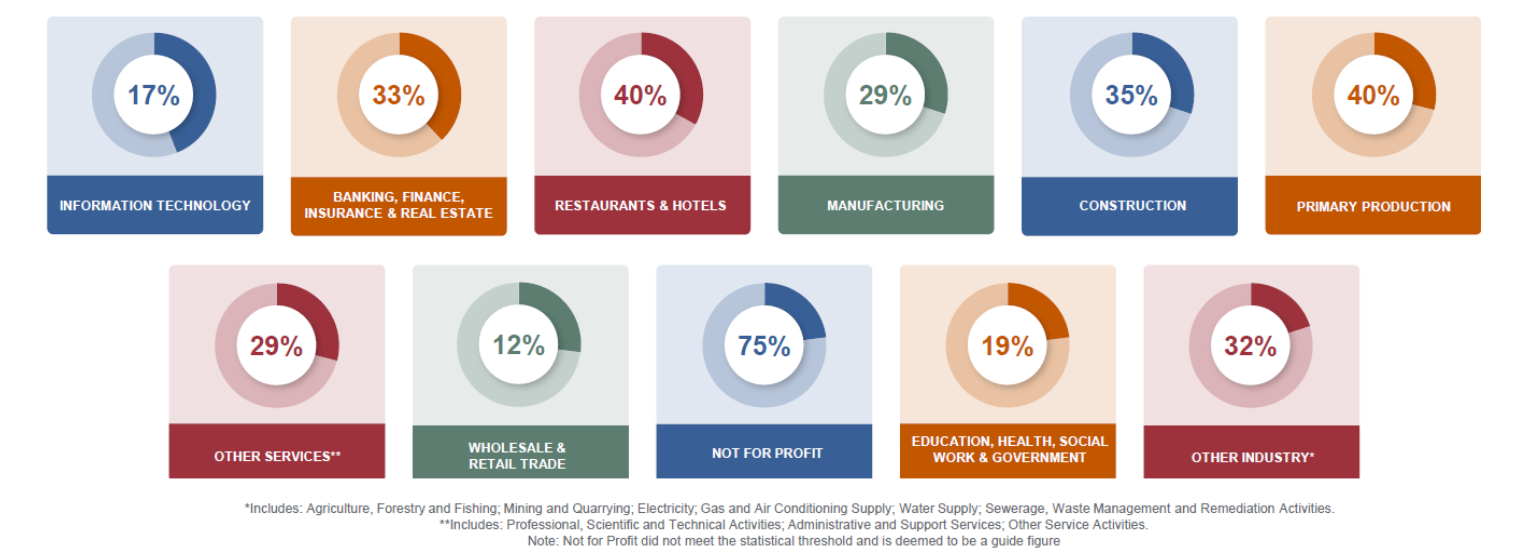

IT & Tech sector reports an Outlook of +17%, a decline of 25 percentage-points compared with Q3.

Dublin’s overall hiring intention is down 25%, driven by the decline in the tech sector.

Dublin-based Banking & Finance sector still performing robustly with an Outlook of +33%.

Irish employers report lower quarterly hiring intentions for Q4 2022, according to the latest ManpowerGroup Employment Outlook Survey as confidence drops, mainly due to inflationary and macro-economic concerns. In the fourth quarter of 2022, employers of all sizes plan to slow hiring, lowering the national hiring Outlook to +28% – a decline of 12 percentage-points on last quarter, and a decrease of 6 percentage-points year-on-year.

These hiring Outlook figures are still high by historic levels but do indicate a slowdown from previous record high figures at the start of 2022. The Net Employment Outlook (NEO) is derived by taking the percentage of employers planning to increase headcount and subtracting the percentage expecting to decrease headcount.

The Technology, IT, Telecom and Media sector is recording the sharpest fall in Net Employment Outlook in Q4 of 2022, at +17%, down -25 percentage-points on last quarter and a decline -44 percentage-points year-on-year. This decline is primarily driven by a sharp rise in outplacements as tech companies restructure from their hiring boom of early 2022. Early post pandemic recovery, previous high volume hiring campaigns, slowing tech sector growth, and rising interest rates have all knocked confidence in the sector going into the fourth quarter.

In Q4 2021 the Tech sector was Ireland’s highest performing sector, and remained among the highest performing throughout 2022, but is now recording the second lowest employment Outlook of any sector. Businesses that drove hiring confidence in the Tech & IT sector over the last year are now having to reduce worker numbers rather than they take on new staff for growth. Layoffs in the Tech & IT sector have become much more prominent in the last quarter, a shift driven by large tech companies who may have over-hired coming out of the pandemic as their markets re-opened and now find themselves with a surplus of employees, which is now forcing them to divest some recent hires and retract some job offers. Despite this, hiring overall remains in double digits, driven largely by small and medium sized firms outside the big-tech space.

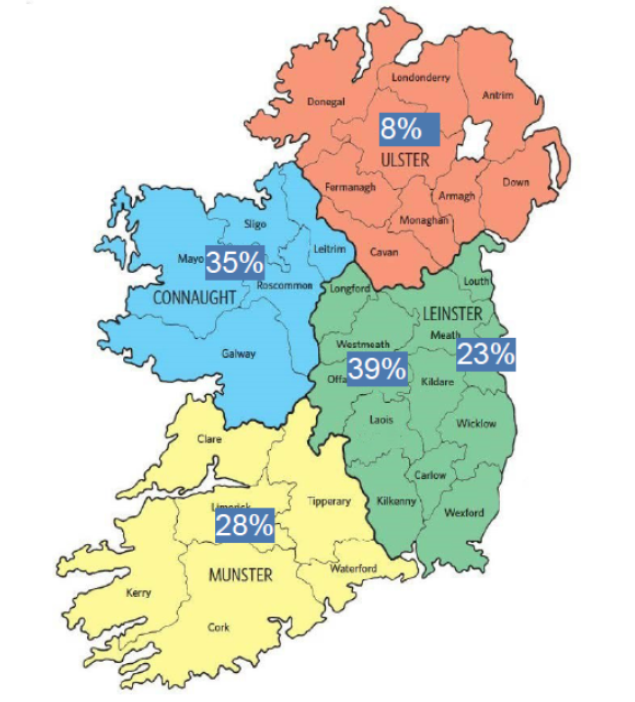

Hiring decision makers in all regions in Ireland plan an increase in staffing levels in the fourth quarter of 2022. The most competitive region in Ireland is Leinster, with an NEO of +39%, rising 16 percentage points year-on year. The region with the largest increase since this time last year is Connaught, which reports a rise of 27 percentage points. Indeed, this quarter is the highest NEO recorded in Connaught since ManpowerGroup started tracking data in Q1 2005, which demonstrates the increasing strength of the west of Ireland economy.

As our economic situation changes the impacts in the marketplace are felt most strongly in Dublin. In previous quarters, the strong hiring optimism recorded by the IT & Tech sector was a big part of keeping Dublin’s employment Outlook buoyant. Now our data shows the number of employers in the Capital’s Tech sector looking to reduce staff has tripled since the last quarter, which is a substantial part of why we’re tracking a decline in the City’s overall hiring intentions.”

The IT, Technology Telecoms and Media sector is recording the sharpest fall in NEO in Q4 of 2022, at +17%, a decline of 25 percentage points on last quarter and a decline of 44 percentage points year-on-year. This decline is driven by a rise in layoffs and slowing growth in the tech sector as companies restructure after their hiring boom in early 2022. Early post pandemic recovery patterns, previous high-volume hiring campaigns, slowing sectorial growth, and rising interest rates have all knocked confidence in the sector going into the fourth quarter.

The Banking & Finance sector remains Dublin’s strongest industry and a leading sector across Ireland, with an employment Outlook of +33%, a decline of -16 percentage-points on last quarter’s record high and up +5 percentage-points year-on-year. The Dublin-based Banking & Finance sector is reporting strong fourth quarter Outlook on record along with Hotels/Restaurants and the Production sector. Despite cooler hiring intentions, this demonstrates Dublin is continuing to perform as a global centre of business financial activity. We view this as a continued vote of confidence in Ireland’s economy during a time of economic uncertainty going into the fourth quarter.

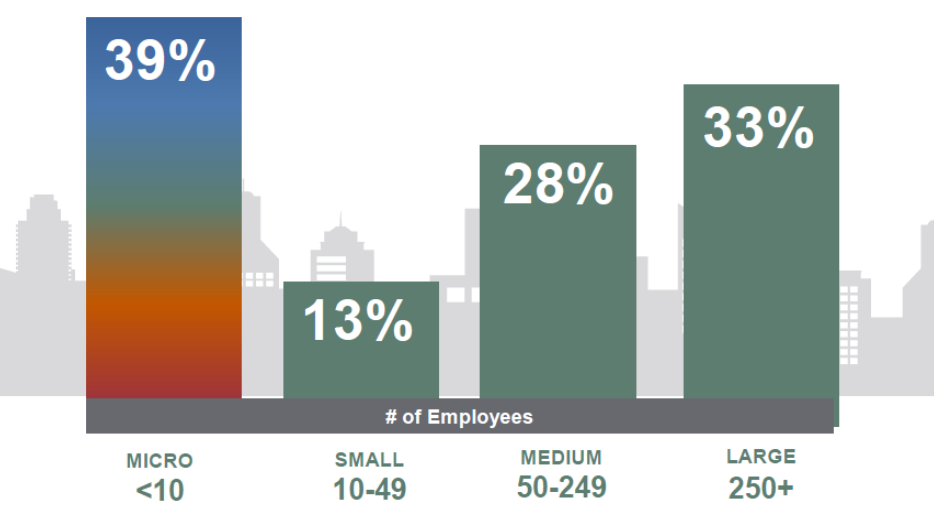

Hiring managers in companies of all sizes anticipate an increase in staffing levels in Q4 2022. Irish employers in organisations with fewer than ten employees are the most optimistic, with a NEO of +39. This is the highest NEO recorded in Irish organisations with less than 10 employees since we started tracking data in Q1 2005. “The Tech slowdown in Dublin aside, we are encouraged by the continued strength of the hiring market in other regions – particularly Connaught, where we continue to see strong hiring optimism across a range of in-demand roles”

What does all this mean for companies in Ireland?

Irish companies will be looking at their hiring plans more strategically going into Q4. There is still high demand for skilled talent and an ongoing talent shortage in the labour market but hiring volume will decrease as employers tighten their belts. We will see this first in Dublin, and where Dublin leads the other regions will follow. Smaller companies will be hiring in greater strength than ever before, which highlights the increasing prominence of start-up companies in Ireland. The waters may be getting a bit choppier, but the sails are still firmly raised with recruitment remaining buoyant as the year closes out.

Email: [email protected]